Equine Diagnostic Services Market is Expanding at USD 1.27 Billion by 2035 | Fact.MR Report

Analysis of Equine Diagnostic Services Market Covering 30+ Countries, Including analysis of US, Canada, UK, Germany, France, Nordics, GCC countries

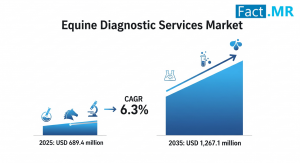

ROCKVILLE, MD, UNITED STATES, August 20, 2025 /EINPresswire.com/ -- Fact.MR today released its latest report on the Equine Diagnostic Services Market, providing comprehensive insights into the global market’s steady growth driven by the rising prevalence of equine infectious diseases and musculoskeletal disorders. Valued at USD 689.4 million in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 6.3%, reaching USD 1,267.1 million by 2035. This expansion highlights the increasing adoption of advanced diagnostic technologies in veterinary care to ensure the health and performance of horses across diverse applications.For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=5229

Market Outlook and Growth Projections:

The equine diagnostic services market is poised for significant growth from 2025 to 2035, fueled by heightened awareness among horse owners and veterinarians about equine health and the need for precise diagnostics. Services such as genetic testing, infectious disease testing, and phenotype testing are critical for managing equine health in sports, leisure, and breeding. The report projects the market to grow from USD 689.4 million in 2025 to USD 1,267.1 million by 2035, with a CAGR of 6.3%.

Key Drivers Fueling Market Demand:

The primary drivers of the equine diagnostic services market include the rising incidence of equine infectious diseases, such as equine influenza and streptococcus equi, and musculoskeletal disorders, which account for a significant portion of veterinary interventions. The report highlights growing awareness among horse owners about preventable ailments, such as equine coronavirus and trypanosomosis, driving demand for diagnostic services. The global equestrian market, encompassing leisure, racing, and betting, further fuels the need for advanced diagnostics to ensure horse performance and safety. Innovations like next-generation sequencing (NGS) and molecular assays, coupled with support from organizations like the American Association of Equine Practitioners for regulations like the Horseracing Integrity & Safety Act, are accelerating market growth. Additionally, the adoption of telehealth and ISO-compliant practices in veterinary care enhances accessibility and efficiency.

Challenges and Restraints in the Sector:

Despite its promising outlook, the market faces challenges that could impede growth. The high cost of advanced diagnostic equipment, such as MRI systems and molecular assays, limits adoption in smaller veterinary practices, particularly in developing regions. The report notes that concerns over disease transmission, including during the COVID-19 pandemic, restricted non-urgent diagnostic testing, impacting short-term market expansion. A global decline in equine populations, particularly in some regions, also poses a challenge to market growth.

Segment-Wise Insights and Dominant Trends:

The report provides detailed segmentation analysis, identifying infectious disease testing as the dominant service type, projected to hold a significant market share due to its critical role in managing diseases like equine influenza and anemia. Genetic testing is the fastest-growing segment, with a projected CAGR of 7.1%, driven by demand for hereditary disease screening and performance analytics. By service setting, hospitals and clinics lead, holding a major share due to the adoption of full-body scanning and MRI systems, while lab and mobile testing are growing rapidly at a CAGR of 6.8%, fueled by advancements in molecular assays and software expertise.

Buy Report – Instant Access: https://www.factmr.com/checkout/5229

Regional Outlook and Growth Hotspots:

North America dominates the market, holding a significant share due to its large equine sports and leisure industry, advanced healthcare infrastructure, and high adoption of diagnostic technologies in the U.S. and Canada. Europe follows closely, with the UK leading as a front-runner in the global equine industry, supported by robust veterinary networks. The Asia-Pacific region is expected to exhibit the fastest growth, with a projected CAGR of 7.5%, driven by increasing equine sports activities, rising awareness of infectious diseases, and investments in veterinary infrastructure in countries like China, India, and Japan. Latin America and the Middle East and Africa (MEA) are emerging markets, supported by growing equestrian tourism and healthcare investments.

Recent Developments:

The equine diagnostic services market has seen notable advancements in 2024 and early 2025. In 2024, Animal Genetics Inc. launched an NGS-based panel for hereditary disease screening, enhancing precision in equine diagnostics. Etalon Inc. introduced predictive performance analytics for equine athletes, adopted by breeders in North America. Recent posts on X highlight innovations like DNA profiling for cattle breeding, indicating broader trends in genetic diagnostics that could influence equine applications. Additionally, regional veterinary centers like B&W Equine Vets expanded diagnostic integration, offering comprehensive health management solutions.

Key Players Insights:

Leading players in the market are advancing diagnostic technologies and expanding their global presence. Animal Genetics Inc. and VetGen lead in hereditary disease and color genetics testing, serving breeders across North America and Europe. Emerging players like Etalon Inc., EquiSeq Inc., and Equine Diagnostic Solution Inc. are revolutionizing the market with NGS-based panels and personalized health solutions. IDEXX Laboratories and Neogen Corporation focus on infectious disease diagnostics, with recent launches of rapid testing kits for equine influenza. B&W Equine Vets and other regional centers are integrating diagnostics into clinical services.

Competitive Landscape:

The market features a competitive ecosystem with key players driving innovation and market share. Companies profiled include Animal Genetics Inc., VetGen, Etalon Inc., EquiSeq Inc., Equine Diagnostic Solution Inc., IDEXX Laboratories, Neogen Corporation, and B&W Equine Vets. These firms lead in developing advanced diagnostic solutions for equine health management. The report includes a detailed competition dashboard, benchmarking, and market share analysis, highlighting strategies such as product innovation, partnerships with veterinary clinics, and expansion into high-growth regions.

Check out More Related Studies Published by Fact.MR Research:

Preventive Healthcare Technologies & Services Market is anticipated to reach $557.5 Mn by 2028, growing steadily at a 13% CAGR.

Mobile Imaging Services Market is poised to reach over US$ 2.7 Billion by 2032, increasing from US$ 1.8 Billion in 2021. MRI to be the largest segment.

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.